Atlas Investment Technologies, LLC

Systematic, machine learning driven trading across liquid U.S. ETFs.

Atlas Investment Technologies employs a fully systematic, machine learning driven trading strategy focused on liquid U.S. exchange-traded funds and macroeconomic trends. The system is designed to generate uncorrelated absolute returns across a range of market environments.

The objective is to deliver attractive risk adjusted returns with low correlation to major asset classes, while maintaining strict risk discipline throughout the trading day.

A disciplined, repeatable process from data ingestion to execution.

This section contains sensitive fund information. Please login to view these details.

This section contains sensitive fund information. Please login to view these details.

Access to the Atlas Fund is strictly limited to qualified purchasers and accredited investors by invitation only. Detailed terms, fee structures, and liquidity provisions are available for approved partners.

Withdrawals are generally processed at year-end. Investors submit requests via the application; subject to available liquidity, proceeds are distributed after Q4.

Funds may also be distributed to meet tax obligations or in the event of intentional liquidation. In extraordinary circumstances, the fund manager reserves the right to limit or defer withdrawals. Deposits can be made throughout the year but must be confirmed before they appear on an investor's dashboard.

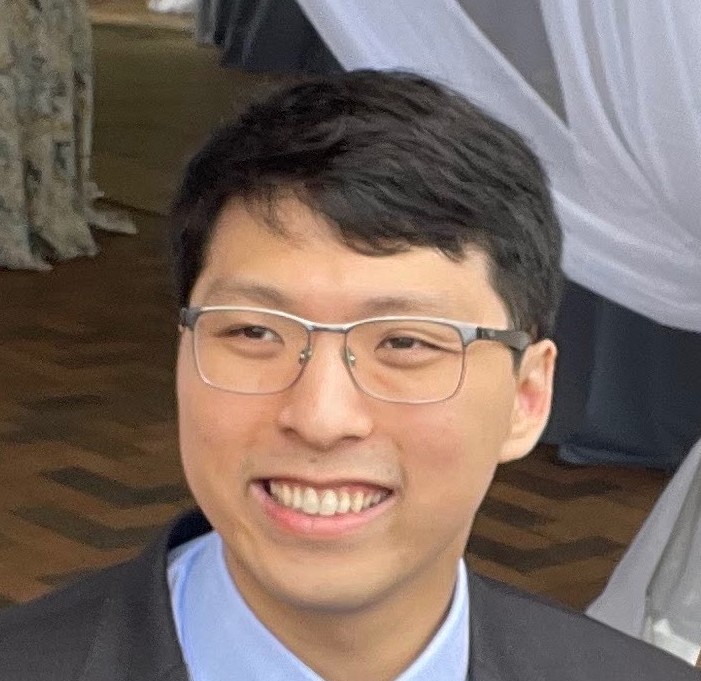

Gregory is a former Google Machine Learning Engineer with a Master's degree in Computer Science (Machine Learning focus) and an undergraduate degree in Computer Science and Economics from Brown University. At Google he worked on consumer-facing ML systems at Google Cloud and on recommendation models at YouTube, including models that generated over $11 million in ARR and contributed to core metric improvements.

The strategy implemented in the Atlas Fund is an institutionalization of the systematic approach Gregory previously used for his own trading. The thesis is straightforward: leverage AI to amplify human macro and thematic intuition, while delegating intraday reaction and position sizing to models trained on millions of data points.

As fund manager, Gregory is responsible for supervising the research pipeline, monitoring model performance, managing risk parameters, and evolving the infrastructure that powers the Atlas Fund and its investor reporting platform.

Backtested and live results are monitored continuously; live performance is visible in the investor portal.

Performance data is available to authorized investors via the secure portal. The strategy utilizes a systematic, risk managed approach to target absolute returns uncorrelated to broader market indices.